Chemical, Biological, Radiological and Nuclear (CBRN) Security Market Growth Outlook Beyond

The analysts of a recent business intelligence study by Transparency Market Research (TMR) has detected that the global chemical, biological, radiological, and nuclear (CBRN) security market is quite consolidated in nature with four companies reserving nearly 70% of the total shares in 2016. The four companies who are ahead of the curve, viz. Honeywell International, 3M Company, MSA Safety, and Ansell Ltd., have established themselves by expanding geographically, frequently indulging in mergers and acquisitions as well as eyeing strategic collaborations.

For instance, the 3M Company acquired Scott Safety in Market 2017, adding the North Carolina based company to its portfolio. Boeing Company, Unisys Technologies, Lockheed Martin, International Business Machines Corporation (IBM), Accenture, and Siemens AG are some of the other notable companies currently holding a notable position in the global CBRN security market.

Global CBRN Security Market to be worth US$15,074.8 mn by 2025

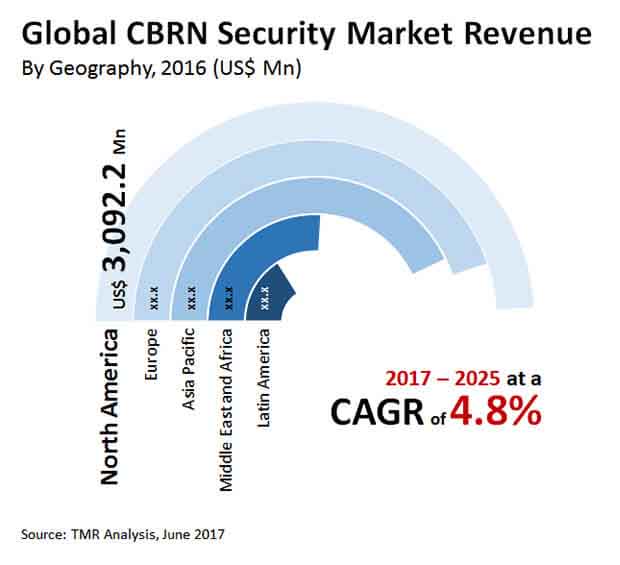

According to the projections of the TMR report, the demand in the global CBRN security market will multiply at a CAGR of 4.8% during the forecast period of 2017 to 2025, by the end of which the opportunities in the market are estimated to translate into a revenue of US$15,074.8 mn, substantially up from its evaluated worth of US$9,890.0 mn in 2016.

Based on type, the TMR report segments the CBRN security market into chemical, biological, radiological, and nuclear, with the latter providing for more than 33.8% of the total demand in 2016. On the back of strict government regulations and international laws pertaining to nuclear products, this particular segment is expected to maintain its leadership position throughout the forecast period. Based on function, the report bifurcates the market for CBRN security into detection equipment, protection equipment, simulation systems, and decontamination equipment, with the protection equipment currently providing for the maximum demand.

Comments

Post a Comment